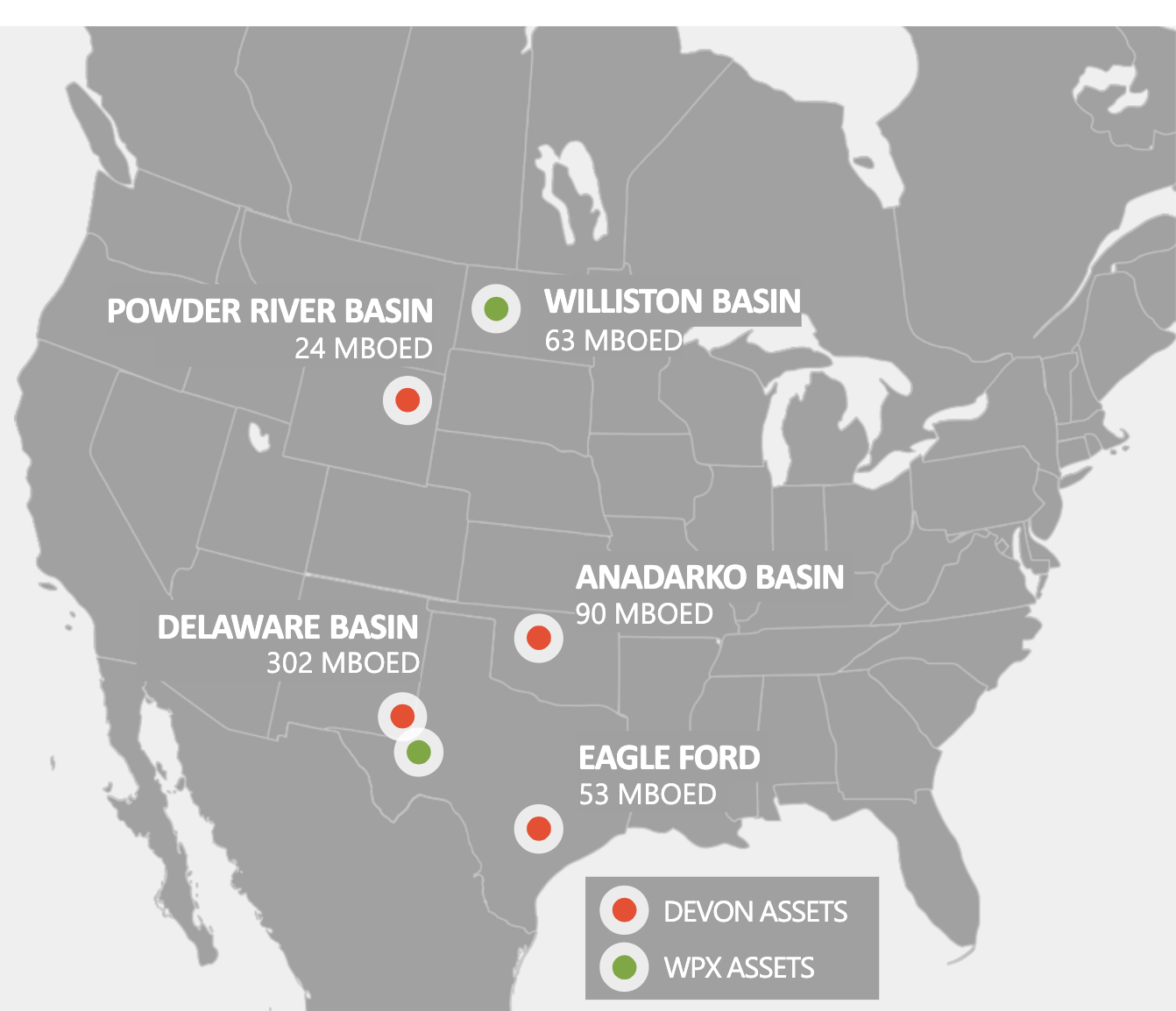

About 35 percent of the leases are on federal land, which could be affected by a potential drilling ban if former Vice President Joe Biden were to win November's election. The combined company will have 400,000 acres in the Delaware Basin that spans West Texas and New Mexico. with a production of 277,000 barrels per day. This new wave of consolidations is expected to create larger companies but employ fewer workers.ĬONSOLIDATION: Chevron's $13 billion Noble takeover sets off a potentially dangerous waveĭevon’s acquisition of WPX will create one of the largest shale players in the U.S. Chevron in July announced plans to acquire Houston-based Noble Energy in a $13 billion deal, scheduled for a shareholder vote next month. Weak oil demand and low prices caused by the pandemic is pushing energy companies to join forces to weather the downturn.

and with our enhanced scale and strong financial position, we can now accomplish these objectives for shareholders more quickly and efficiently,” WPX CEO Rick Muncrief said. “The combined company will be one of the largest unconventional energy producers in the U.S. “This merger is a transformational event for Devon and WPX as we unite our complementary assets, operating capabilities and proven management teams to maximize our business in today’s environment, while positioning our combined company to create value for years to come,” Devon CEO Dave Hager said.

0 kommentar(er)

0 kommentar(er)